2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 8

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1E

- 1EB

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2P

- 2PB

- 2Q

- 3BE

- 3C

- 3CA

- 3E

- 3EB

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7P

- 7PB

- 7Q

- 8BE

- 8CA

- 8E

- 8EB

- 8P

- 8PB

- 8Q

- 9BE

- 9CA

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10CA

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11CA

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12E

- 12EB

- 12Q

- 13E

- 13EB

- 13Q

- 14E

- 14EB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 22E

- 22EB

- 23E

- 23EB

- 24E

- 24EB

- 25E

- 25EB

- 26E

- 26EB

E Co. Provides two types of pumps, one for commercial purpose and the smaller one for residential purpose, we need to calculate ending inventory under FIFO and dollar value LIFO.

Accounting:

a. Calculating Ending inventory and cost of goods sold under FIFO:

Residential Pumps:

Calculating ending inventory Under Periodic FIFO

| Date | Number of units | Cost per unit | Total |

| March 25 | 300 | 500 | $150,000 |

| March 15 | 200 | 475 | $95,000 |

| Total cost $245,000 |

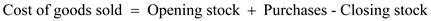

Calculation for cost of goods sold (COGS) under FIFO

Opening stock = (200×$400) $80,000

Add: Purchases (225,000+190,000+150,000) $565,000

Less: closing stock ($245,000)

Cost of goods sold $400,000

Commercial Pumps:

Calculating ending inventory Under Periodic FIFO

| Date | Number of units | Cost per unit | Total |

| March 21 | 500 | 1,000 | $500,000 |

| Total cost $500,000 |

Calculation for cost of goods sold (COGS) under FIFO

Opening stock = (600×$800) $480,000

Add: Purchases (540,000+285,000+500,000) $1,325,000

Less: closing stock ($500,000)

Cost of goods sold $1,305,000

Total ending inventory: $245,000+$500,000 = $745,000

Total cost of goods sold: $400,000+$1,305,000 = $1,705,000

b.

Calculating ending inventory and cost of goods sold under Dollar value LIFO

Calculating ending inventory of current year in units:

Residential pumps 500

Commercial pumps 500

Total 1,000

| Year Dec. 2014 | Closing stock at current cost as Calculated Above: | Closing stock at base year cost |

| Residential pump: | $245,000 | $200,000 ( 500×$400 ) |

| Commercial pump: | $500,000 | $400,000 (500×$800 ) |

| Total | $745,000 | $600,000 |

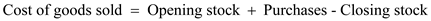

Calculating price index =

= 1.242

For Calculating inventory cost under dollar value LIFO following steps are followed:

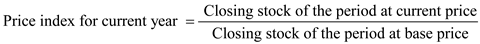

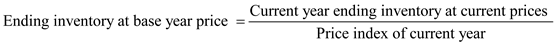

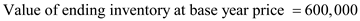

1. Calculate value of ending inventory of current year at base- year- prices using following formula

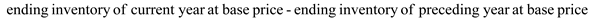

2. Quantity increase in real dollar terms can be calculated as follows:

Calculating ending inventory of preceding year (base year):

| Year Dec. 2013 | Closing stock |

| Residential pump: | $80,000 (200×$400) |

| Commercial pump: | 480,000 (600×$800) |

| Total | $560,000 |

=600,000- 560,000

=$40,000

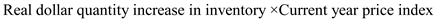

3. Convert real dollar quantity increase at current year prices as follows:

=40,000×1.242

=$49,680

4. This increase is known as LIFO layer and this increase should be added to the beginning inventory of current year to get the total inventory at the end of current year.

=560,000+49,680

=$609,680

Inventory on 31st December 2014 under LIFO dollar value = $609,680

Calculating cost of goods sold:

Cost of goods sold = beginning inventory + purchases – ending inventory

Calculating purchases

| No. of units | Cost/unit | total | |

| Residential | 500 400 300 | 450 475 500 | $225,000 190,000 150,000 |

| Commercial | 600 300 500 | 900 950 1,000 | 540,000 285,000 500,000 |

| Total | 1,890,000 |

Beginning inventory = $560,000

Ending inventory = $609,680

Cost of goods sold = $560,000+$1,890,000-$609,680

=$1,840,320

Analysis:

a) Current ratio indicates the amount of current asset that company have to meet its short term liabilities and FIFO shows inventory at the price almost equal to current market price therefore it serves the purpose better, whereas Dollar value LIFO lowers down the numbers state in financial statement by showing inventory at low cost

b) Analyst would be able to compare the results of company using different inventory valuation method by calculating one company’s inventory amount as per other’s inventory valuation method, though it is a complex task, analyst must be able to determine reasonably correct estimate of comparing company’s inventory amount.

Principles:

Company can change from one inventory method to another, but not allowed to do it back and forth. They do it for the better understanding of its financial performance and position to the readers of financial statement. The trade off is between comparability and consistency. Company switches to the method which is used by most of its competitors but as the company now uses different method from one which it uses earlier, consistency is sacrificed. Companies sometimes also changes accounting method as they want to match revenue to expenses and again consistency across the period of financial reporting is sacrificed.

Corresponding textbook