2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 7

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1C

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2C

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7P

- 7PB

- 7Q

- 8BE

- 8CA

- 8E

- 8EB

- 8P

- 8PB

- 8Q

- 9BE

- 9CA

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10BE

- 10CA

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13P

- 13PB

- 13Q

- 14BE

- 14E

- 14EB

- 14P

- 14PB

- 14Q

- 15BE

- 15E

- 15EB

- 15P

- 15PB

- 15Q

- 16BE

- 16E

- 16EB

- 16Q

- 17BE

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 22Q

- 23E

- 23EB

- 23Q

- 24E

- 24EB

- 24Q

- 25E

- 25EB

- 25Q

- 26E

- 26EB

- 27E

- 27EB

Accounts Receivables:

It refers to the money the company is owed from its debtors. It is an asset which is shown under the head ‘Current Assets’. It gives the right to the company to receive the money in the future.

Accounting:

(a)

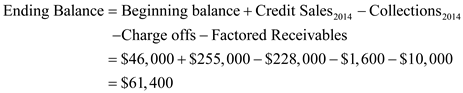

The computation of accounts receivable at the end that is on December 31, 2014 is given below:

The amount of ending balance of accounts receivable is .

.

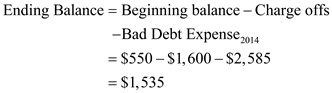

The computation of allowance for doubtful accounts at the end that is on December 31, 2014 is given below:

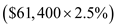

The amount of ending balance of allowance for doubtful accounts is . The amount of ending balance can also be computed as ending balance of accounts receivable multiplied by provision of bad debt that is $1,535

. The amount of ending balance can also be computed as ending balance of accounts receivable multiplied by provision of bad debt that is $1,535  .

.

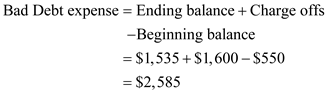

Working Notes:

The computation of bad debt expense for the year 2014 is given below:

The amount of bad debt expense is $2,585.

(b)

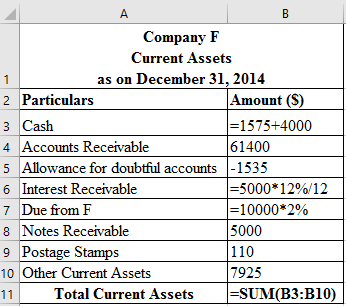

The statement showing current assets section of the balance sheet as on December 31, 2014 is given below:

The above table shows the calculations with the help of formulas.

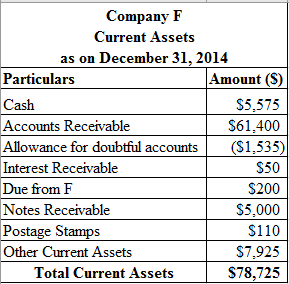

The resultant table of the above table is given below:

The amount of total current assets is .

.

(a)

Current Ratio:

It indicates the company’s ability to meet their short-term liabilities (obligations) when become due. It indicates the proportion of current assets in relation to its current liabilities.

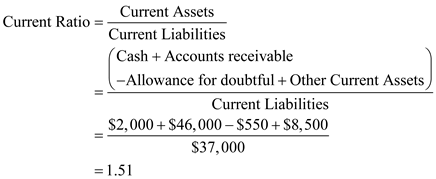

The computation of Current Ratio for the year 2013 is given below:

The current ratio for the year 2013 is .

.

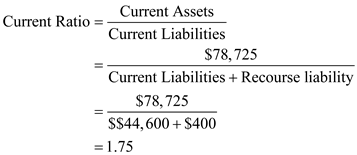

The computation of Current Ratio for the year 2014 is given below:

The current ratio for the year 2013 is .

.

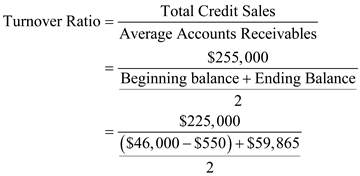

Accounts Receivable Turnover Ratio: It is computed by dividing the amount of total credit sales by average accounts receivables.

The computation of Accounts Receivable turnover ratio is given below:

The accounts Receivable turnover ratio is . The company’s current ratio and accounts receivable turnover ratio has been improved in the year 2014 than the year 2013.

. The company’s current ratio and accounts receivable turnover ratio has been improved in the year 2014 than the year 2013.

(b)

Due to the borrowing that are secured, note payable and accounts receivable would be shown in the books of the Company F. This would result in the reduction in the current ratio and accounts receivable turnover ratio.

Principles:

According to the principle of recognition of expense, bad debt expenses must be recorded at the time of sales. Otherwise, there will be overstated income by the bad debts amount. Additionally, accounts receivable with a net amount of allowances gives a more clear and faithful reporting.

Corresponding textbook