2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 3

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7E

- 7EB

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13Q

- 14E

- 14EB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 21E

- 21EB

- 22E

- 22EB

- 23E

- 23EB

Adjusting entries are the entries that are passed by the company to changes its accounting records into the accruals concepts. Before issuing the financial statement company is required to pass adjusting entries. Such adjusted entries guarantee that items of income statement and balance sheet are updated on the accrual concept.

Company ABC provides additional information and it is required to pass the Adjusting Entries:

1.

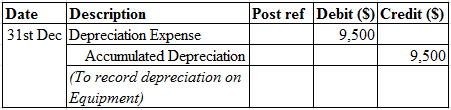

The Equipment is subject to depreciation amounting to $9,500 and the effect of the same is given below:

Depreciation expense is charged during the year therefore recorded at debit side and in order to recognize liability accumulated depreciation would be credited.

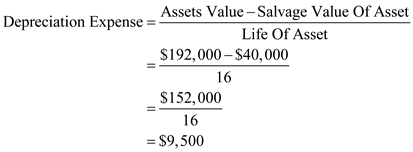

Working Note:

Calculate the amount of depreciation on Equipment:

2.

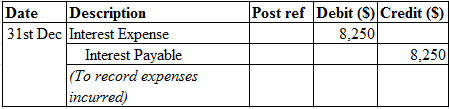

Interest Expense is incurred on notes payable amounting to $8,250 and the effect of the same is given below:

Interest expense is charged during the year therefore recorded at debit side and in order to recognize liability Interest payable would be credited.

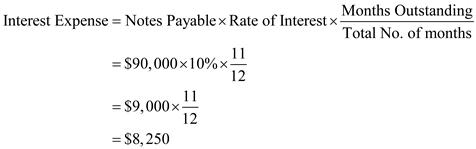

Working Note:

Calculate the amount of Interest expense on Notes payable up to December 31, 2014 (i.e. for 11 months):

3.

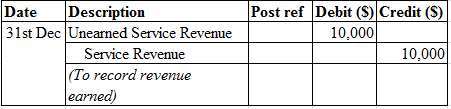

Company earned revenue amounting to $10,000 and the effect of the same is given below:

During the year company earned service revenue therefore it is credited and in order to derecognize liability unearned service revenue would be debited.

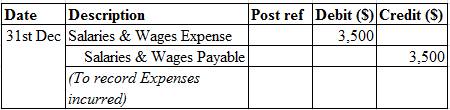

Calculate the amount of revenue earned till December, 2014.

4.

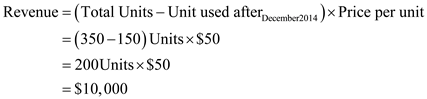

Company incurred advertising expenses amounting to $2,500 and the effect of the same is given below:

Advertising expense is charged during the year therefore recorded at debit side and in order to derecognize assets prepaid advertising would be credited.

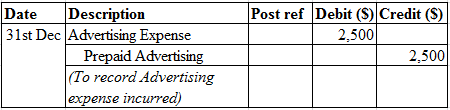

5.

Company incurred advertising expenses amounting to $2,500 and the effect of the same is given below:

Salaries & Wages expense is charged during the year therefore recorded at debit side and in order to recognize liability salaries & wages payable would be credited.

Analysis

As per the given situation ABC’S Income before the adjustment is $360,000 and after the adjustment the company’s Income is:

Hence, Income after adjustment is

From the above, it is analyzed that Company’s Banker should wait for the Company to complete its year end adjustment because after making adjustment banker comes to know about the exact revenue earned by the company during the year and this will guide the banker for renewal of loan.

Principles

For making decision it is required that accounting information should be relevant for the user of information and it should also be presented in a faithful manner because most users does not have expertise to evaluate the contents of information.

As per the basic Principles of Accounting, Financial Statement is prepare quarterly, half-yearly and annually but for making important decision it can also be presented more frequently than quarterly or annually.

Corresponding textbook