2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 21

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12P

- 12PB

- 12Q

- 13E

- 13EB

- 13ICA

- 13P

- 13PB

- 13Q

- 14E

- 14EB

- 14P

- 14PB

- 14Q

- 15E

- 15EB

- 15P

- 15PB

- 15Q

- 16E

- 16EB

- 16P

- 16PB

- 16Q

- 17Q

- 18Q

- 19Q

- 20Q

(Accounting)

Analyzing the lease terms offered to Homer Ltd. against each of the four capitalization criteria:

• Transfer of ownership test: No provision of transfer.

• Bargain-purchase option test: Purchase option of $3,000 approximates the fair value and hence there is no ‘substantial’ gain available.

• Economic life test: Lease term of 3 years is only 60% of the economic life of 5 years.

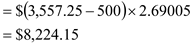

• Recovery of investment test: The present value of minimum lease payment (excluding executory costs) is less than 90% of the fair value. (Calculation below).

As the lease does not satisfy any of the capitalization criteria it is an operating lease.

Calculation of present value of minimum lease payment for 3 beginning of year payments discounted at 12%:

Homer Ltd., under operating lease will simply expense the annual installment payment as rent expense against cash. It will not capitalize the asset and create corresponding lease liability. It will have the following entry at the inception of the lease:

| Date | Particulars | Debit ($) | Credit ($) |

| 01-01-2014 | Lease rent | 33,000 | |

| Cash | 33,000 | ||

| (Lease rent for operating lease) |

(Analysis)

To answer this question it is important to analyze the outlining difference between operating and capital lease. A capital lease will directly add to the list of assets under the balance sheet whereas under the operating nature the asset would be off-balance sheet and yet will earn the same income for the company. Similarly, there would be no liability (periodic payment obligations) on the balance sheet under capital lease.

Therefore, if Homer Ltd. were to capitalize this asset, its return on assets ratio will be less than the actual. This is because the return from the asset use would remain same whereas the asset would be of higher value.

Under capital lease both the debt and total assets would be higher than under operating lease. Thus, debt to total asset will be under-reported if the lease is of operating nature.

(Principles)

A company would often be partial in recognizing lease as capital lease. For reasons mentioned above an operating lease would report a better profitability and financial soundness. A lessee like Homer Ltd. should follow an impartial judgment before evaluating any lease. This would include a correct and objective method of recognizing assets and related lease obligations in its books of accounts.

Corresponding textbook