2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 20

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6CA

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7CA

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9ICA

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10ICA

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11ICA

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12ICA

- 12P

- 12PB

- 12Q

- 13E

- 13EB

- 13P

- 13PB

- 13Q

- 14E

- 14EB

- 14P

- 14PB

- 14Q

- 15E

- 15EB

- 15Q

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 22Q

- 23E

- 23EB

- 23Q

- 24E

- 24EB

- 24Q

- 25Q

- 26Q

- 27Q

- 28Q

- 29Q

Pension plans:

Pension benefits are entitlements received by the employees of an organization in regard to the number of years of service rendered by employees for the organization. However, the payment of pension benefits is held back till the time of retirement of employees, thereafter the amount accumulated through pension benefit is released. The computation of net pension expense for the company comprises of five essential components.

Accounting:

Income statement:

• An income statement reports the results of business transactions over a period, usually for a month or a year.

• In the income statement, total expenses are deducted from total revenues.

• When the total revenue exceeds total expenses over the period, the result is net income.

• When the total expenses exceed total revenue over the period, the result is net loss.

The following is the income statement:

| Particulars | Amounts in $ |

| Revenue | 3,000 |

| Less: | |

| Cost of goods sold | 2,000 |

| Salaries | 700 |

| Pension expense | 82.5 |

| Depreciation expense | 80 |

| Interest | 100 |

| Net income | 37.5 |

Balance sheet:

Balance sheet is a statement of financial position. It is one of the main reports in financial statements. It shows the financial position of the company. Balance sheet will be prepared for a specific period. It summarizes a company’s assets, liabilities and shareholders’ equity. It is prepared by using accounting equation that is ’Assets = Liabilities + Stockholders’ Equity’.

Steps to computing the balance sheet:

• Total assets are derived from current assets, long term investments, property, plant, and equipment, and intangible assets.

• The total liability is derived from current liability, long term debt, contributed capital, and retained earnings.

• The total assets and total liabilities should be equal in the balance sheet.

The following is the Balance Sheet:

| Particulars | Amounts in $ |

| Assets: | |

| Plant and equipment | 2000 |

| Less: accumulated depreciation | 320 |

| Net plant and equipment | 1,680 |

| Inventory | 1,800 |

| Cash | 368 |

| Total assets | 3,848 |

| Liabilities: | |

| Equity share capital | 2,000 |

| Retained earnings | 733.5 |

| Notes payable | 1,000 |

| Pension liability | 114.5 |

| Total liabilities | 3,848 |

| Date | Account and Description | Ref. | Debit | Credit |

| Amounts in $ in millions | ||||

| Pension expense | 82.5 | |||

| Cash | 70 | |||

| Pension assets/liability | 12.5 | |||

|

| (to record the pension expense and the pension liability) |

Analysis:

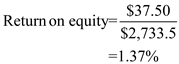

Return on equity:

In this, only the unexpected return on planned assets has not been included in the income statement. If this item had been included in the income, ROE would have been = ($42.5 – $46.8) ÷ $2,460.4 = 17%.

The rationale for excluding this amount from the current period income (and therefore from ROE) is that a defined benefit pension plan is a long-term contract and so it is the long term expected return on the plan’s assets that is relevant to measuring the cost of sponsoring the plan.

Principles :

The effects of plan amendments and actuarial gains and losses in a given year are fairly transitory items with respect with its income. In other words, these are items that are not expected to be repeated in the next financial year. In case, these items are included in the income statements, then the income of the company would be made a little difficult to derive at.

Corresponding textbook