2014 FASB Update Intermediate Accounting (15th Edition) Edit editionThis problem has been solved:Solutions for Chapter 14

Looking for the textbook?- CH1

- CH2

- CH3

- CH4

- CH5

- CH6

- CH7

- CH8

- CH9

- CH10

- CH11

- CH12

- CH13

- CH14

- CH15

- CH16

- CH17

- CH18

- CH19

- CH20

- CH21

- CH22

- CH23

- CH24

- 1AAP

- 1BE

- 1CA

- 1CAC

- 1E

- 1EB

- 1FRP

- 1FSA

- 1ICA

- 1ITQ

- 1P

- 1PB

- 1PR

- 1Q

- 2BE

- 2CA

- 2E

- 2EB

- 2ICA

- 2ITQ

- 2P

- 2PB

- 2Q

- 3BE

- 3CA

- 3E

- 3EB

- 3ICA

- 3ITQ

- 3P

- 3PB

- 3Q

- 4BE

- 4CA

- 4E

- 4EB

- 4ICA

- 4ITQ

- 4P

- 4PB

- 4Q

- 5BE

- 5CA

- 5E

- 5EB

- 5ICA

- 5ITQ

- 5P

- 5PB

- 5Q

- 6BE

- 6E

- 6EB

- 6ICA

- 6P

- 6PB

- 6Q

- 7BE

- 7E

- 7EB

- 7ICA

- 7P

- 7PB

- 7Q

- 8BE

- 8E

- 8EB

- 8ICA

- 8P

- 8PB

- 8Q

- 9BE

- 9E

- 9EB

- 9P

- 9PB

- 9Q

- 10BE

- 10E

- 10EB

- 10P

- 10PB

- 10Q

- 11BE

- 11E

- 11EB

- 11P

- 11PB

- 11Q

- 12BE

- 12E

- 12EB

- 12P

- 12PB

- 12Q

- 13BE

- 13E

- 13EB

- 13P

- 13PB

- 13Q

- 14BE

- 14E

- 14EB

- 14P

- 14PB

- 14Q

- 15BE

- 15E

- 15EB

- 15Q

- 16BE

- 16E

- 16EB

- 16Q

- 17E

- 17EB

- 17Q

- 18E

- 18EB

- 18Q

- 19E

- 19EB

- 19Q

- 20E

- 20EB

- 20Q

- 21E

- 21EB

- 21Q

- 22E

- 22EB

- 22Q

- 23E

- 23EB

- 23Q

- 24E

- 24EB

- 24Q

- 25E

- 25EB

- 25Q

- 26E

- 26EB

- 26Q

- 27E

- 27EB

- 27Q

- 28Q

- 29Q

- 30Q

Long Term Liabilities:

It is referred to as the benefits in the future over the one year period like notes payables maturing more than a one year. It means those liabilities amount which are not payable within a period of one year.

Accounting:

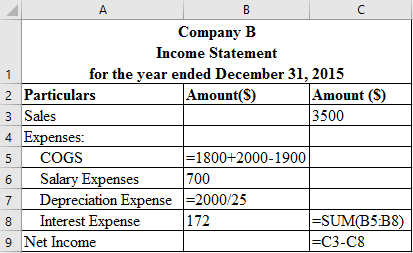

The statement showing the income statement is given below:

The above table shows the calculations with the help of formulas.

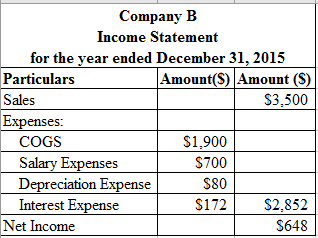

The resultant table for the above table is given below:

The above table shows the income statement.

Working Notes:

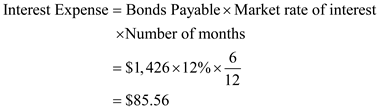

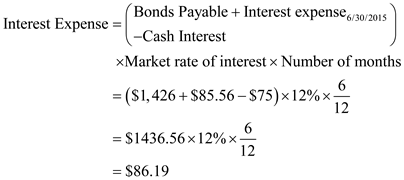

The computation of Interest Expense for the six months that is June 30, 2015 is given below:

The interest expense is $85.56.

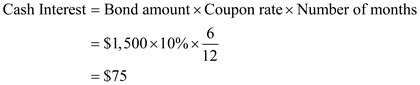

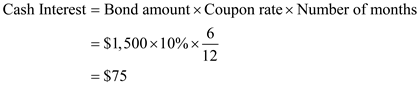

The computation of payment of cash interest for the June 30, 2015 is given below:

The amount of cash payment is $75.

The computation of Interest Expense for the next six months that is December 31, 2015 is given below:

The interest expense is $86.19.

The amount of interest expense is $171.75.

The computation of payment of cash interest for the December 31, 2015 is given below:

The amount of cash payment is $75.

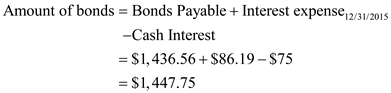

The computation of value of bonds as on December 31, 2015 is given below:

The amount of bonds is $1,447.75.

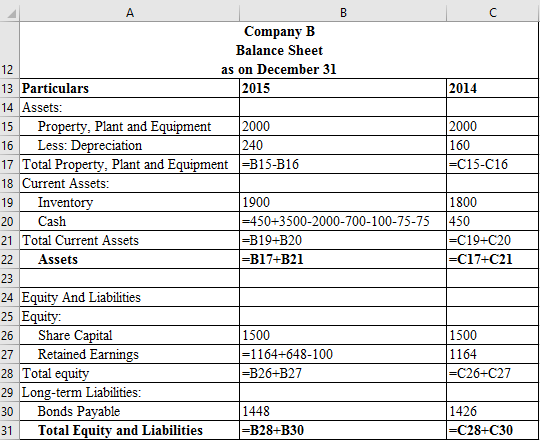

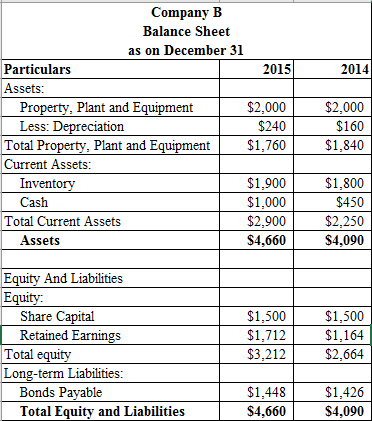

The statement showing the balance sheet as on December 31, 2015 is given below:

The above table shows the calculations with the help of formulas.

The resultant table for the above table is given below:

The above table shows the balance sheet.

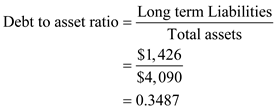

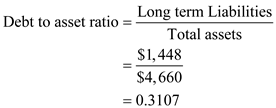

Debt to Asset ratio: This ratio is calculated by dividing long term liabilities to total assets.

The computation of debt to asset ratio for the year 2014 is given below:

The debt to asset ratio is 34.87%.

The computation of debt to asset ratio for the year 2015 is given below:

The debt to asset ratio is 31.07%.

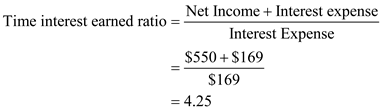

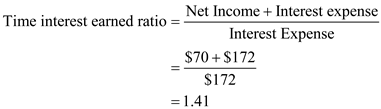

Time interest earned ratio:

The computation of time interest earned ratio for the year 2014 is given below:

The interest earned ratio is 4.25.

The computation of time interest earned ratio for the year 2015 is given below:

The interest earned ratio is 1.41.

Principles:

There may be an argument regarding consideration of faithful representation or a relevant representation. According to some people, for taking financing or investing decisions, the fair value of the assets and liabilities of the company should be taken.

However, it is a management’s decision to show the value of asset or liability on the basis of FV (fair value). But according to some people, debt’s fair value is not relevant, if the company is not paying the debt before time.

Corresponding textbook